*APR=Annual Percentage Rate. Rates based on an evaluation of your credit score and your actual rate may vary. Rates subject to change without notice and not all applicants will qualify. Other rates and terms available. $50 government recording fee due at time of application. HE loans are limited to 85% of property value minus any existing liens. Loans are limited to one to four family, owner occupied or second homes which are residential properties. Loans are limited to Berks, Bucks, Carbon, Lehigh, Montgomery, Northampton and Schuylkill counties. An appraisal will be required at time of application at borrower’s expense. Finance charges may be tax deductible. Please consult your tax advisor for details.

**1-year introductory rate = 1% off current qualifying rate and will automatically adjust up 1.00% 12 months after disbursement. Payment Example: You pay $28.65 per month for every $1,000 financed. APR may vary. Payment is based upon $1,000 borrowed. $5,000 minimum new money. Offer expires October 31, 2014.

***Payment Example: You pay $10.11 per month for every $1,000 financed. APR may vary. Payment is based upon $1,000 borrowed over 120 months. $5,000 minimum. Offer expires October 31, 2014.

2014 Holiday Loan 2014 Holiday Loan

If you want to make your family’s holiday dreams come true without draining your savings account, try a Holiday Loan from LVECU. With rates as low as 3.99%* apr for 12 months, you can borrow from $500 to $2,500.

*You pay $85.15 per month for every $1,000 borrowed. Not all applicants will qualify and your actual rate may vary. Rates subject to change.

2015 Scholarships

LVECU will be awarding ten $1,000 scholarships to members who will be full-time undergraduate students during the upcoming 2015-2016 school year. Applications will be available November 1, 2014 on our website or at either office. Some restrictions apply.

Celebrate International Credit Union Day: Local Beginnings Bring Global Change

Copyright 2014 Credit Union National Association Inc. Information subject to change without notice. For use with members of a single credit union. All other rights reserved.

The credit union idea arose centuries ago as people worked under a common effort without thought of profit – they put out fires, harvested crops, and avoided high-priced loans by lending to one another.

In the 1850s, hard times hit Germany, and people turned to each other for help. They removed small savings from under mattresses and made reasonably priced loans to one another, forming the original credit unions. In the 1920s, Edward Filene took cooperative finance to the next level in Boston, as a means of lifting working people out of debt and creating a better life.

On January 17, 1927, the Credit Union League of Massachusetts celebrated the first official credit union holiday. January 17th is the birthday of Benjamin Franklin, America’s “Apostle of Thrift,” who credit union founders believed to symbolize the purpose and spirit of credit unions. During this time, the credit union movement was new and spreading.

Click here for full article.

Help us celebrate this year’s International Credit Union

Day theme of: Local Service. Global Good.™

By donating $1 to the Krysta Hankee Miles That Matter Campaign, and receive a hot dog & drink at the Allentown Office, and a snack & drink at the Schnecksville branch.

When: Thursday, October 16th from 11:30 a.m. to 5:30 p.m. |

Board of Directors Election 2015 ... Your Chance to Make a Difference!

Elections for the 2015 Board of Directors will be here before you know it. Make sure to let your voice be heard by voting for the credit union leaders who will work for you.

To become even more involved, you can contribute your time and talents by running for one of three board positions. Any member in good standing who would like to be nominated for the positions available may send a letter of introduction (100 words or less) to: Nomination Committee, c/o LVECU, 3720 Hamilton Blvd., Allentown, PA 18103. The deadline for receiving letters is November 30, 2014. Ballots and biographies will be mailed (if necessary) to all members age 12 and over after the close of nominations. To become even more involved, you can contribute your time and talents by running for one of three board positions. Any member in good standing who would like to be nominated for the positions available may send a letter of introduction (100 words or less) to: Nomination Committee, c/o LVECU, 3720 Hamilton Blvd., Allentown, PA 18103. The deadline for receiving letters is November 30, 2014. Ballots and biographies will be mailed (if necessary) to all members age 12 and over after the close of nominations.

By a resolution of the Board of Directors, incumbent directors will be automatically re-nominated if they wish to run. The Nominating Committee may nominate one additional person for each position. Anyone not nominated by the committee may have his/her name added to the ballot for any position by submitting a nominating petition with the signatures of 25 LVECU members. Petitions are available at the LVECU Main Office.

Nominees must be members in good standing as defined by the following criteria: all entrance fees have been paid, all loans with the Credit Union are current, and the Credit Union has suffered no losses as a result of a charge-off or discharge in bankruptcy of any loans or obligations.

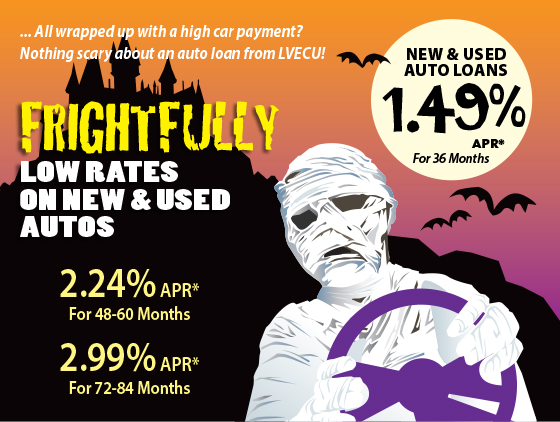

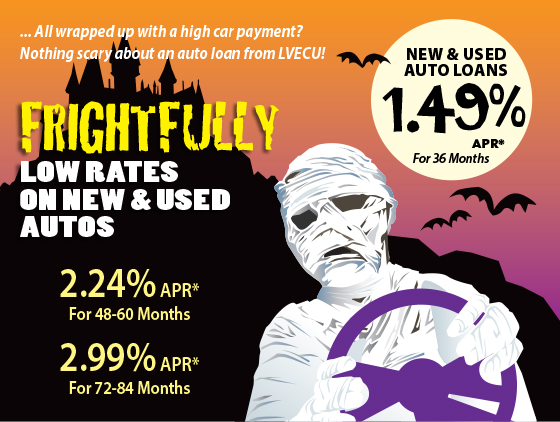

*APR = Annual Percentage Rate. Not all applicants will qualify. Rates subject to change without notice. Rates based on credit guidelines, your actual rate may vary. Percentage off discounts cannot be combined. Payment example: You pay $28.42 per month for every $1,000 financed.

Fast Fact: Most Payday Loans Lead to More Payday Loans

by Center for Personal Finance editors

More than 80% of short-term loans taken out at payday lenders are rolled over or followed within two weeks by another loan, the Consumer Financial Protection Bureau (CFPB), Washington, D.C., reports in a study of these arrangements. CFPB Director Richard Cordray says the bureau study “again confirms that payday loans are leading many consumers into longer-term, expensive debt burdens.”

Click here to read more.

Kirby & CU Succeed Summer Reading Program & More

Summer’s come and gone and so has our Summer Reading Program. This year 174 Kirby and CU Succeed members participated in the program by reading more than 1,382 books! What an impressive feat! Also, CU Succeed member Claudia Frantz was our 2nd quarter drawing winner. Claudia received a $100 deposit. If you’re age 13-17, stop into the credit union and enter. Summer’s come and gone and so has our Summer Reading Program. This year 174 Kirby and CU Succeed members participated in the program by reading more than 1,382 books! What an impressive feat! Also, CU Succeed member Claudia Frantz was our 2nd quarter drawing winner. Claudia received a $100 deposit. If you’re age 13-17, stop into the credit union and enter.

Young Adults Saving ... Still Struggling

by News Now editors

The Great Recession taught many hard lessons to American consumers, including millennials.

According to a recent survey by Wells Fargo, 80% of millennials, or those born between 1980 and the early 2000s, say the 2008 economic downturn showed them they need to save now to ensure they can survive economic problems in the future.

Unfortunately, in many cases this lesson has not led to action, as only 55% report that they’ve started saving for retirement. Broken down by gender, 61% of males have started saving compared with 50% of females.

Read more here.

Children’s Christmas Party (ages 10 and under)

Before you know it, the holidays will be here! Save the date for the Children’s Christmas Party which will be held on Saturday, December 6th at Trexler Middle School.

Children enjoy a snack & juice, craft bag, and the opportunity to sit on Santa’s lap and tell him what they want for Christmas! Watch your mail for more information. This event is limited to the first 200 Kirby Club members age 10 & under. Look for your invitation in the mail in October and sign-up early!

The RSVP deadline is November 1, 2014.

*APR=Annual Percentage Rate. Subject to credit guidelines and not all applicants will qualify. Offer expires 1/31/15.

Financial Literacy Help for Educators!

If you’re looking for a way to introduce financial literacy to your students, LVECU can help! We have a financial literacy resource available through our website called Practical Money Skills for Life. You can find Practical Money Skills for Life on our Links page, click on the ‘For Educators’ tab (or follow this link ), and you will have access to teaching guides and lesson plans for students age K-12 and beyond. It’s a great resource, it’s FREE, and it’s just one more benefit of being an LVECU member!

|

2014 Holiday Loan

2014 Holiday Loan

To become even more involved, you can contribute your time and talents by running for one of three board positions. Any member in good standing who would like to be nominated for the positions available may send a letter of introduction (100 words or less) to: Nomination Committee, c/o LVECU, 3720 Hamilton Blvd., Allentown, PA 18103. The deadline for receiving letters is November 30, 2014. Ballots and biographies will be mailed (if necessary) to all members age 12 and over after the close of nominations.

To become even more involved, you can contribute your time and talents by running for one of three board positions. Any member in good standing who would like to be nominated for the positions available may send a letter of introduction (100 words or less) to: Nomination Committee, c/o LVECU, 3720 Hamilton Blvd., Allentown, PA 18103. The deadline for receiving letters is November 30, 2014. Ballots and biographies will be mailed (if necessary) to all members age 12 and over after the close of nominations.

Summer’s come and gone and so has our Summer Reading Program. This year 174 Kirby and CU Succeed members participated in the program by reading more than 1,382 books! What an impressive feat! Also, CU Succeed member Claudia Frantz was our 2nd quarter drawing winner. Claudia received a $100 deposit. If you’re age 13-17, stop into the credit union and enter.

Summer’s come and gone and so has our Summer Reading Program. This year 174 Kirby and CU Succeed members participated in the program by reading more than 1,382 books! What an impressive feat! Also, CU Succeed member Claudia Frantz was our 2nd quarter drawing winner. Claudia received a $100 deposit. If you’re age 13-17, stop into the credit union and enter.